The current situation of the global industrial robot market

Release Date:2025/05/10

Industrial robots, also known as industrial robots, are not the silly robotic arms we used to see, but rather an "intelligent production expert" with three core capabilities:

Firstly, autonomous navigation, which can locate in real-time through sensors and move precisely like an experienced driver.

Secondly, flexible transformation, it can quickly switch programs according to different work tasks, such as moving goods today and welding tomorrow.

Thirdly, stable output, its repeated positioning accuracy can reach 0.02 millimeters, which is much more stable than our human hands.

These characteristics make them the "saviors" of flexible manufacturing - from welding workshops in automotive factories to precision assembly on mobile phone production lines, replacing us humans to complete the "three highs" of high repetition, high precision, and high risk.

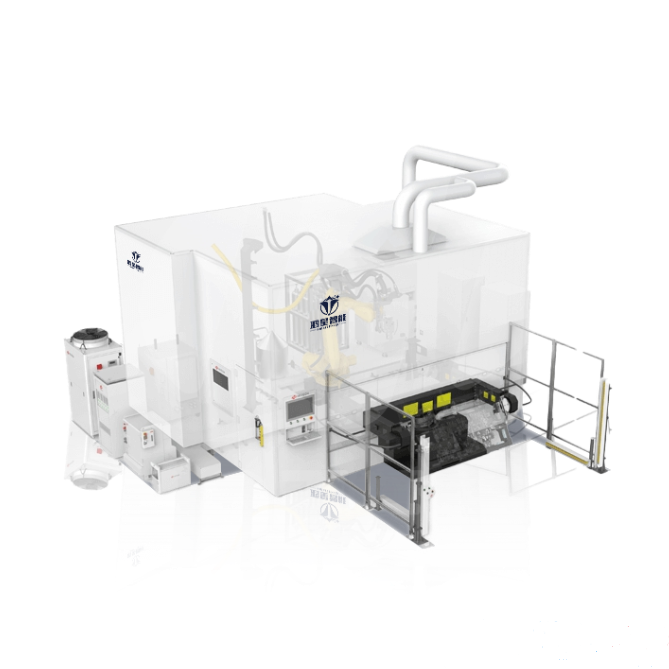

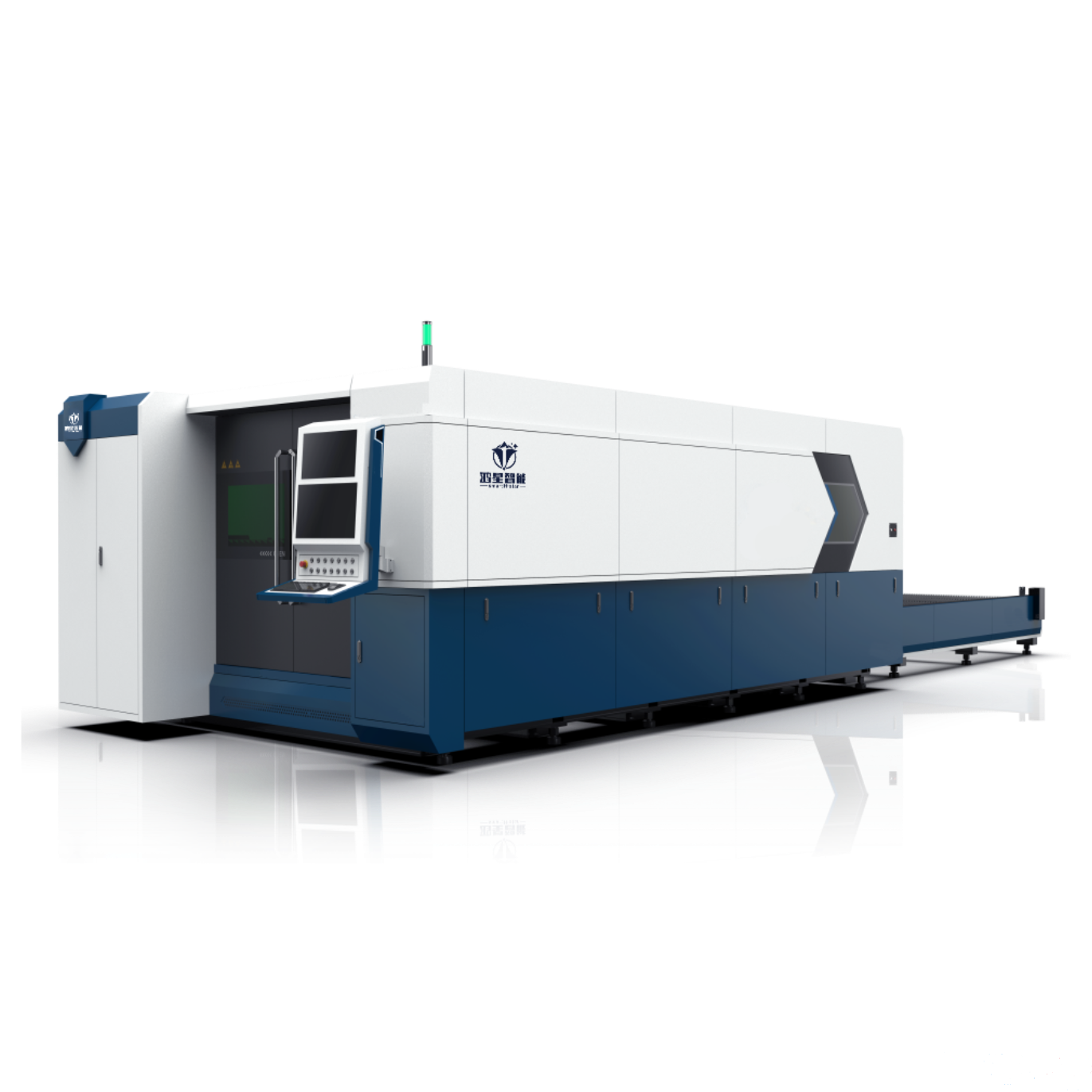

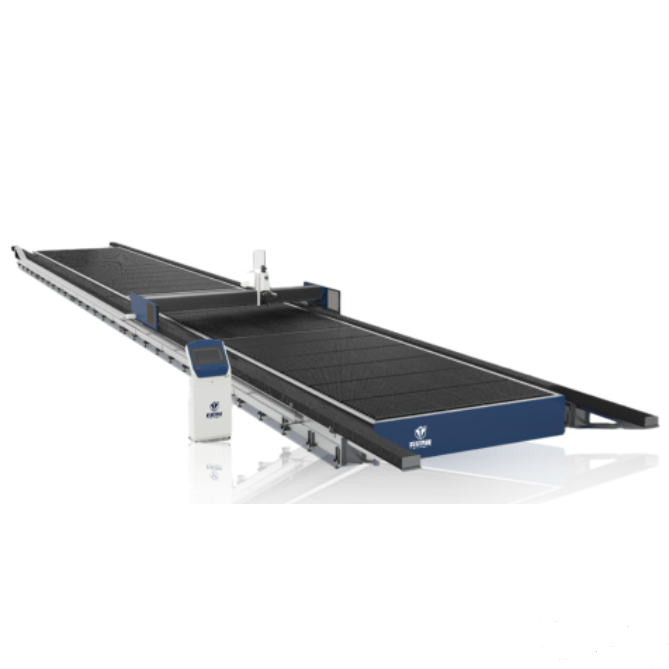

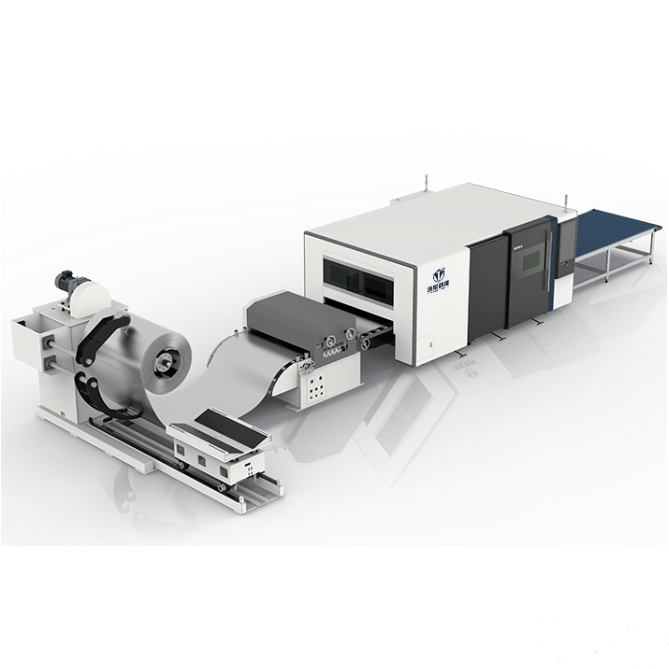

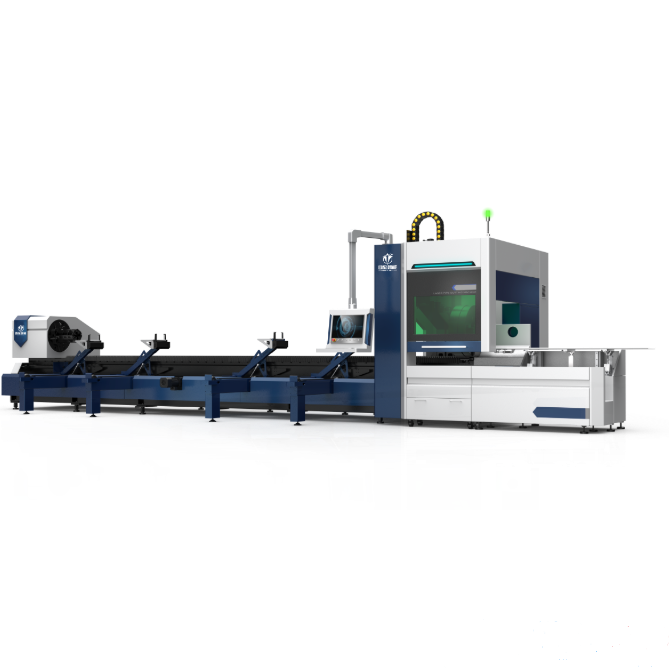

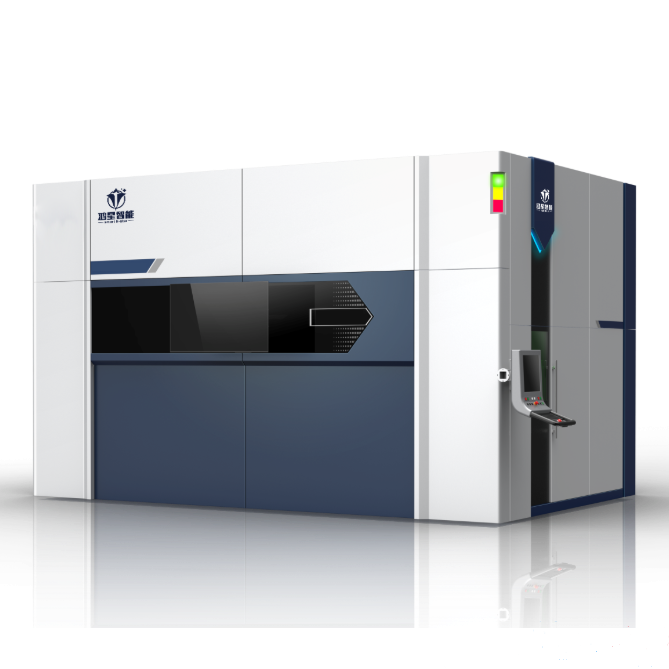

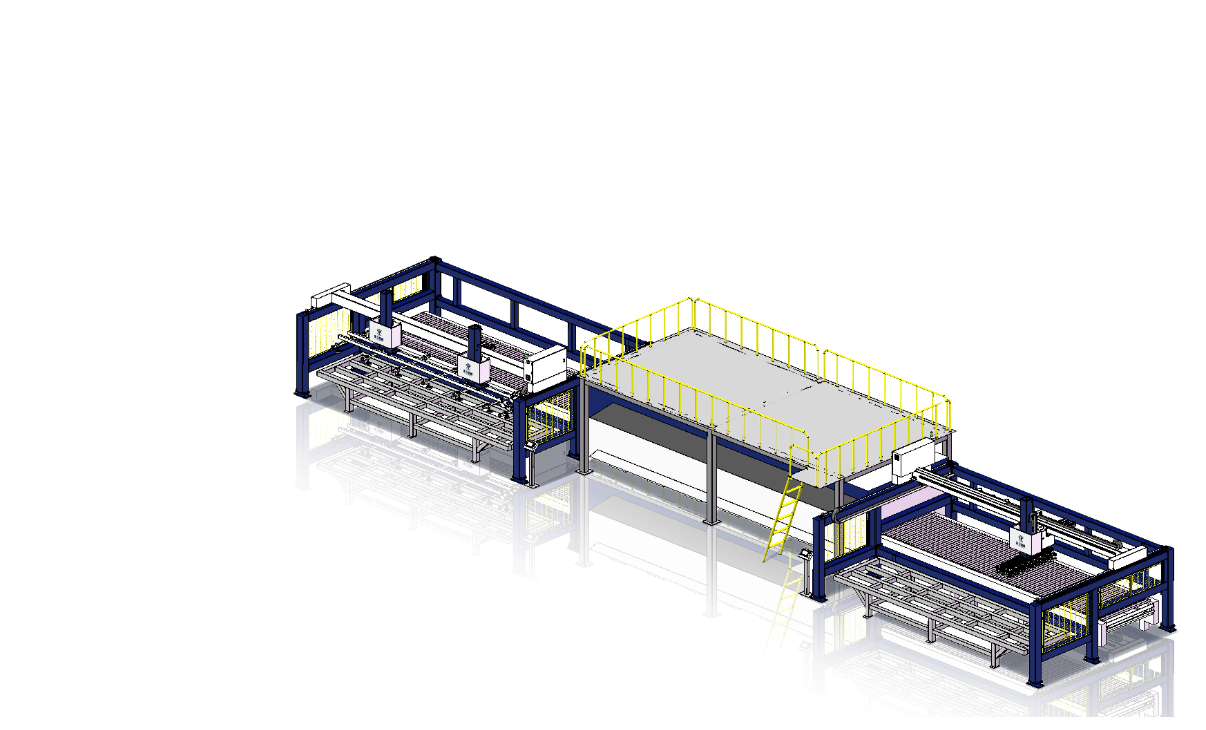

According to their functions, industrial robots can be divided into handling robots, processing robots, assembly robots, spraying robots, laser processing robots, vacuum robots, etc.

Industrial robots not only bring efficiency improvements, but also a revolutionary change in production relations.

In the automotive industry, welding robots have reduced the production cycle of bicycles from 72 hours to 18 hours; In the field of 3C electronics, assembly robots have reduced the changeover time of mobile phone production lines from 2 hours to 15 minutes; In the special scenario of aerospace, vacuum robots have solved the problem of extreme environmental operations that humans cannot bear.

1. Market size and competitive landscape

You may not know that for every two industrial robots produced globally, one is in China. In 2024, China's industrial robot production reached 556400 sets, a year-on-year increase of 14.2%, with a market size approaching 70 billion yuan - a figure equivalent to one tenth of Tesla's global total revenue in 2024.

But don't think this is just us' self pleasuring '. The global market is also betting wildly: the five major industrial countries of China, the United States, Japan, South Korea, and Germany plan to invest over 13 billion US dollars in robot research and development by 2025.

Why? Because 'replacing humans with machines' is no longer a multiple-choice question, but a survival question.

Everyone knows that the hourly wage of Chinese workers is lower than that of American workers, but the installation density of robots in China is many times that of the United States.

Why? Behind this is our triple consideration of Chinese policies, industrial chain, and costs.

There is an interesting detail here: in 2024, the sales of industrial robots in China will decline by 5% year-on-year, but exports will grow by 15% against the trend. What does this mean? The domestic market is digesting inventory, while the overseas market is being torn open by Chinese brands, and stepping onto the international stage has become a necessary path for Chinese industrial robot manufacturers.

Now, the cost of manufacturing a robotic arm in the United States that is similar to the UniversalRobots UR5e (Danish U-Robot) is about 2.2 times that of China. More importantly, even if labeled as "Made in the United States", these components still heavily rely on Chinese components and raw materials, and alternative solutions cannot be found.

The global competition in the robotics industry is relatively concentrated, mainly dominated by four major families: FANUC from Japan, Yaskawa Electric from Japan, KUKA from Germany (acquired by Midea from China), and ABB from Switzerland.

These "four major families" continue to maintain a leading position in the robotics industry with their profound technological accumulation in the fields of machine tools, servo systems, and welding equipment, occupying half of the world's market share.

In the Chinese market, although the "four major families" once held a 70% market share, with the rise of our domestic brands, this number has dropped to 30%.

As a leading industry in the current growth trend, industrial robots are highly regarded by various regions in China, especially driven by the strong leadership and accelerated layout of the two major economic centers, the Pearl River Delta and the Yangtze River Delta. Regions such as Beijing Tianjin Hebei, central China, western China, and Northeast China have accelerated their entry into the market, forming a group combat situation of "six major regional linkage".

Chinese robotics companies are rapidly rising, with companies such as Eston, Efte, and Xinsong accelerating their layout through mergers and acquisitions of European companies.

These enterprises adopt a deep vertical integration strategy: 95% of Estun's core components are self-developed and produced independently, achieving rapid product iteration;

Efte plans to build a "super factory" with an annual production capacity increase of 100000 units;

Xinsong has a global production base of 2.3 million square feet, and has also acquired a German mechanical engineering school and established its own robotics academy, building a dual circulation system of technology and talent.

Although the traditional Big Four (ABB, KUKA, Fanuc, Yaskawa) still dominate the industrial robot market, their lagging innovation has opened up a breakthrough for Chinese companies.

The expansion of Chinese enterprises is not only a corporate behavior, but also a systematic breakthrough driven by national strategy.

2. Industrial chain and technological bottlenecks

The cost structure of industrial robots is very similar to that of smartphones, with 70% of the money spent on "invisible" core components.

The industrial chain of this industry can be divided into three major links: upstream robot basic raw materials and core components, midstream robot whole machine manufacturing, and downstream robot system integration and application.

The upstream of the industrial chain mainly provides basic raw materials and core components, with key core components including servo systems, reducers, and controllers, which directly affect the performance, stability, and load capacity of robots.

Decelerators, servo systems, controllers, these terms may sound dull, but for example: reducers are "joints", servo systems are "muscles", and controllers are "brains". And China is staging a counterattack of "domestic substitution".

For example, the localization rate of harmonic reducers has risen from 20% five years ago to 52.5%, and companies such as New Sword Transmission and Green Harmonic have even entered the overseas supply chain. However, high-end chips are still "hard hit" - Nvidia's AI training chip and Qualcomm's edge computing solution still dominate the computing power of robot "brain".

The most alarming thing is the 'software hegemony'. 80% of the value of global robots still lies in software, while the United States still holds the high ground of "intelligent decision-making" with "magic weapons" such as VLA visual language models and Google Gemini spatial algorithms.

Although Chinese manufacturers Yushu Technology and Ubiquitous have low hardware costs, in order for robots to "understand human language" and "autonomously avoid obstacles", they cannot do without paying tuition fees to Silicon Valley.

3. Application scenario differentiation

The battlefield of industrial robots is no longer as simple as factory assembly lines.

In China, new energy vehicles are the number one "gold mine" - the white body of a car requires more than 3000 welding points, relying on workers? It's more reliable to have welding robots work 24 hours a day.

In 2024, sales of welding robots skyrocketed, and shipyards around the world are rushing to purchase robotic arms produced in China. Another invisible battlefield is 3C electronics. 60% of the assembly process for our mobile phones is also contracted by SCARA robots.

Looking at other places, robots in semiconductor workshops manipulate chips like embroidery girls, and robots on new energy production lines code batteries more efficiently than mahjong tiles.

Speaking of big things like photovoltaic panels and power batteries, from cutting to stacking, they are now fully enclosed by robotic arms. Even the movers in express warehouses and the production lines of smart homes have become the new stage for industrial robots.

And what about the United States? They prefer 'high-precision'. Boston Dynamics' Atlas robot is capable of backflips, Tesla Optimus is handling goods in warehouses, and Figure AI's medical robot can even assist in surgical procedures.

But the problem is that these cool products are particularly expensive and their production capacity cannot keep up. A surgical robot can be priced as high as 10 welding machines in China.

So you see, China is "crushing on a large scale", the United States is "showing off its technology", and no one dares to slack off.

Because everyone knows that the future showdown may take place on two new battlefields - humanoid robots and AI embodied intelligence.

The global industrial robot market is like a song of ice and fire: China has made rapid progress through its industrial chain and cost, while the United States has built a moat through AI and software.

But don't forget, the real winner will always be a player who can both "be a welder" and "write code".